How Gymshark used negative cash conversion cycles to build a billion-dollar business

4.8 (755) In stock

4.8 (755) In stock

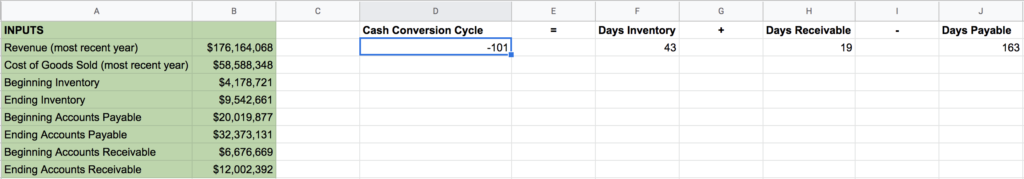

Share59TweetShareWhatsAppEmail59 SharesAlbert Einstein once said, “Compound interest is the eighth wonder of the world. He, who understands it, earns it, and he, who doesn’t, pays it.” In business, a negative cash conversion cycle is the ninth world wonder, enabling companies to grow without the need for external capital. I have previously explored unit economics in […]

Is Gymshark worth $1.4 Billion?

From $0 to $1 Billion - How Gymshark Grew Their Business!

How Gymshark Founder Built a Billion Dollar Company (+ 3 Lessons We Can Learn From This) - Wishpond Blog

UAE's Mubadala and SoftBank invest in American parking startup ParkJockey at valuation over $1 billion

Gymshark part 2: co-founder exits, billionaire tax planning, securing the bag, and cash crunches

The Power Of Having a Negative Cash Conversion Cycle

Gymshark Receives Investment Valuing Athletic Apparel Brand at $1.3 Billion, by Joshua Schall, MBA

Quinn Robertson on LinkedIn: I think of businesses like this: A marketing/sales cost “input”… That…

How Gymshark used negative cash conversion cycles to build a billion-dollar business

The Power Of Having a Negative Cash Conversion Cycle

Quinn Robertson on LinkedIn: No-code / low-code / AI-aided development feel like they've helped be a…

Carlton Smith on LinkedIn: How Gymshark used negative cash conversion cycles to build a…

Gymshark part 2: co-founder exits, billionaire tax planning, securing the bag, and cash crunches