Death of Seamless Flow of ITC in 2022 – Major Changes under GST

4.9 (515) In stock

4.9 (515) In stock

The wonder baby seamless flow of ITC which raised so many hopes and reduced the burdens, had been slowly placed into precarious health condition of late. On the Budget 2022 day it has been put on ventilator with no hope of recovery. The day when changes of Finance Act, 2022 are put into effect would be the date of death of seamless flow of ITC.

EM Feb Issue 2022 by Icon Media Group - Issuu

PDF) Impacts of stereotyping on the criminal justice system

Ease of GST compliance: Still a distant dream - The Economic Times

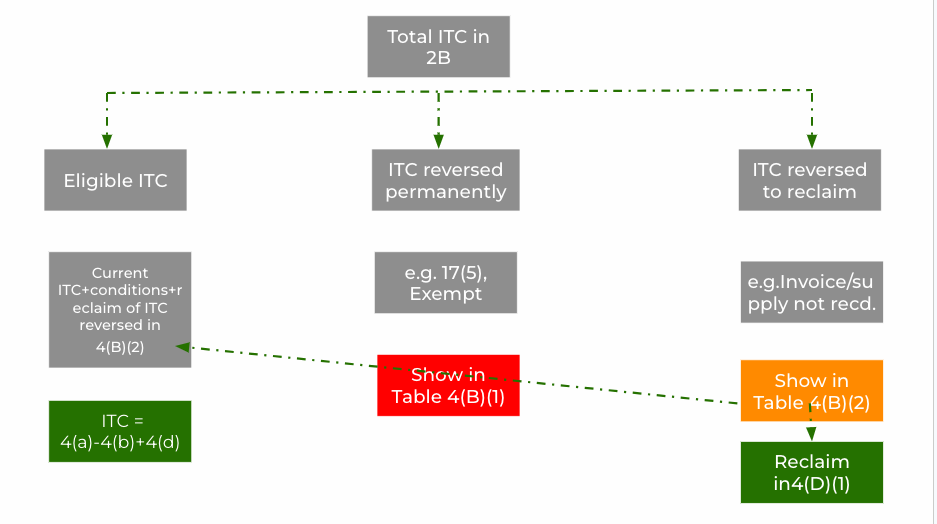

What to Do for Claiming GST ITC & Reversal for FY 22-23

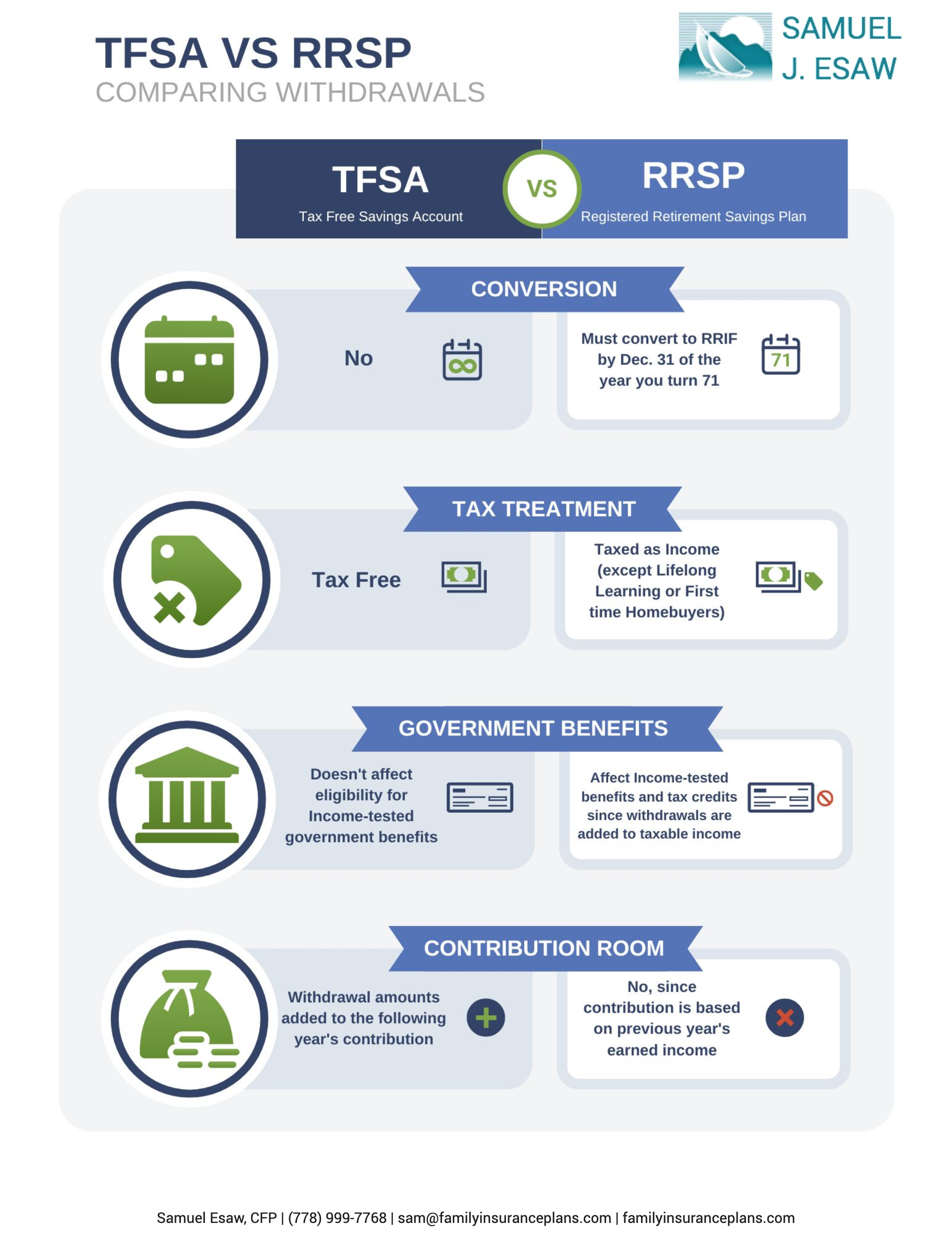

Blog – Samuel J. Esaw

ITC Reversal under GST

GST Archives » Legal Window

CA Praveen Sharma 's Profile

New scheme of claiming ITC in GST w.e.f. 01-09-2023 New scheme of

GST New Era in 2022: Important Changes effective 1st Jan, 2022

Part 9-GST - Areas of Business Impacted (1)