What is the journal entry to record a foreign exchange transaction

5 (610) In stock

5 (610) In stock

A foreign exchange transaction gain occurs when the transaction currency is different than the reporting currency for the company. On the initial transaction date, they would record the $100 sale with a debit to accounts receivable and a credit to revenue. However, 30 days later when the customer goes to pay using the current exchange

5 Accounting for Foreign Currency Transactions and Hedging Foreign Exchange Risk. - ppt download

Foreign Exchange Gains or Losses in the Financial Statements – dReport in English

Forex Trading Journal: Foreign Exchange Trading Log Book To Record Investments & Improve Strategies: : Publications, Black Forest: 9798771708133: Books

SOLVED: Journal entries for an account receivable denominated in Euros (USD weakens). Assume that your company sells products to a customer located in France on October 15. The invoice specifies that payment

Transaction level forex rate for journal entries - Manager Forum

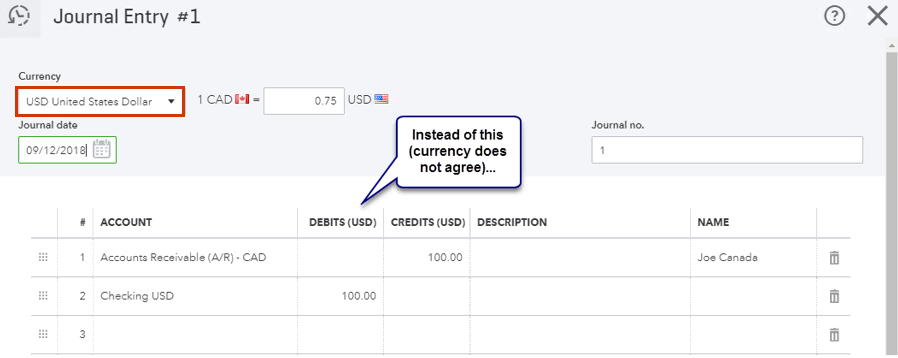

Multi-Currency: Journal Entry Error Message

foreign currency - How to record foreign currency payment? - Treezsoft Blog

Accounting Journal Entries for Foreign Exchange Gains and Losses

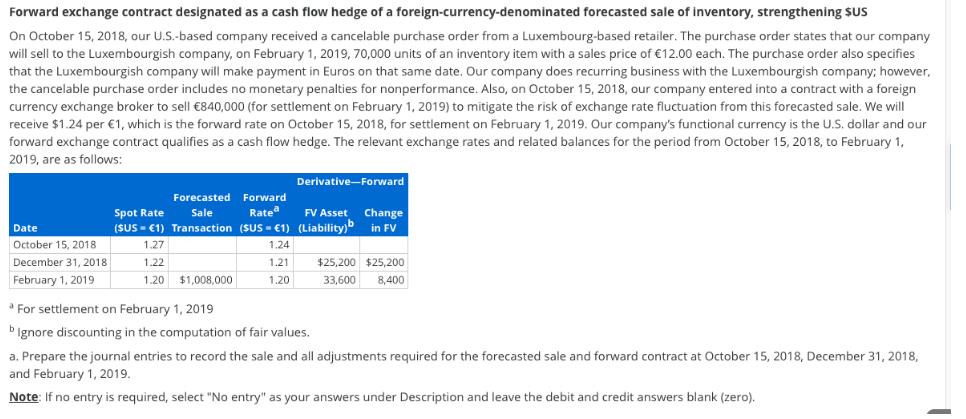

Solved] Forward exchange contract designated as a